In 2025, Southeast Asia’s logistics ecosystem is racing to keep pace with shifting global supply chains, and Vietnam is emerging as a standout success. With China +1 manufacturing strategies in full swing, growing intra-ASEAN trade, and rising e‑commerce penetration, the region’s ports, roads, and logistics hubs are all undergoing rapid expansion and modernization.

In this article, we’ll explore how Southeast Asia is responding to tariff uncertainty, diversification trends, infrastructure bottlenecks, and sustainability expectations. We’ll share our practical insights into where logistics capacity is growing, how trade routes are evolving, and what this means for procurement and sourcing strategies in 2025.

Supply Chain Diversification & Trade Shifts

As global sourcing strategies pivot away from heavy China dependence, Southeast Asia is becoming the preferred destination for diversified manufacturing, and logistics networks are having to evolve just as quickly to keep up.

The Manufacturing Shift Is Regional

Across the region, foreign direct investment into manufacturing is accelerating. Vietnam continues to see strong inflows into greenfield manufacturing (approximately $16 billion in 2023), with Indonesia achieving over $30 billion in the same period. This is about shifting production footprints, new industrial zones, and deeper integration into global value chains.

Meanwhile, export activity is growing across the region. For instance:

- Vietnam’s exports climbed from $320 billion in 2019 to over $440 billion in 2023, driven by electronics, textiles, and machinery.

- Thailand and Malaysia are expanding in automotive and high-tech components, while the Philippines is building momentum in semiconductors and shared services.

This regionalisation trend supports greater resilience, and it’s reshaping how logistics hubs, consolidation points, and cross-border networks are planned.

Trade Is Moving Closer to Home (and Faster)

Roughly 88% of trade flows in Southeast Asia now remain within the Asia-Pacific region, according to McKinsey. This highlights a growing shift toward intra-regional supply chains and shorter lead time expectations.

With these patterns, demand for efficient port access, streamlined customs clearance, and real-time shipment visibility is intensifying, particularly in Vietnam, where growing North American and European exports are converging with strong ASEAN trade ties.

Infrastructure Expansion & Logistics Resilience

Southeast Asia’s logistics capacity is catching up and moving ahead. To support booming trade volumes and diversified sourcing, governments and private investors are pouring capital into ports, airports, expressways, and warehouse infrastructure. It’s not uniform progress, but the momentum is real.

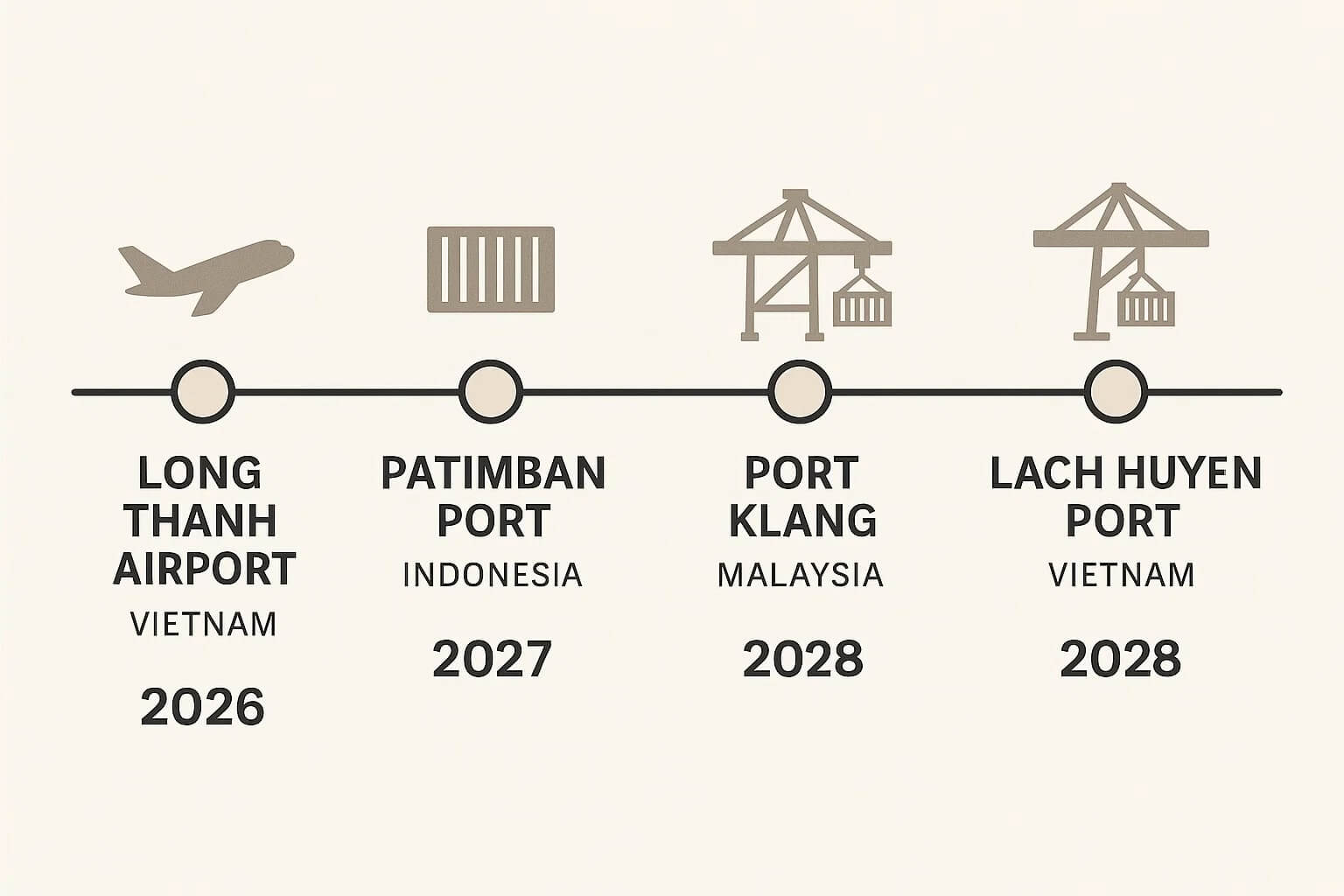

Port and Airfreight Projects Pick Up Speed

Deep-water port expansion is a priority across the region.

- Vietnam is expanding capacity at Lach Huyen and Cai Mep–Thi Vai to handle larger vessels and boost container throughput.

- Malaysia is enhancing Port Klang’s logistics ecosystem, while Indonesia is investing heavily in Patimban Port to ease reliance on Tanjung Priok.

In parallel, new airport investments are unlocking cargo potential. Long Thanh International Airport in southern Vietnam, set to open in 2026, is projected to process up to 5 million tonnes of cargo annually, creating a new air logistics gateway for high-value, time-sensitive goods.

Expressways & Inland Access

Road connectivity remains patchy in places, but progress is visible.

- Vietnam’s North–South Expressway East is linking Hanoi to HCMC with over 2,000 km of high-speed transport corridors.

- Thailand and the Philippines are both ramping up logistics park development tied to improved road freight access.

Better infrastructure gives procurement teams more flexibility when managing inventory flow, cross-border shipments, and contingency planning.

E‑commerce & 3PL Innovation

Southeast Asia’s e-commerce sector is reshaping the region’s logistics model. Higher SKU complexity, shorter delivery expectations, and the rise of omnichannel retail are driving major shifts in how 3PLs operate and where inventory is stored.

Fulfillment Networks Get Closer to the Customer

Gone are the days when centralised mega-warehouses could serve entire countries efficiently. Today’s logistics networks are increasingly:

- Distributed across key urban areas for same-day or next-day delivery

- Designed with smaller, modular formats to manage SKU fragmentation

- Supported by regional sortation centres that speed up intra-city movement

Vietnam is a standout here, with e-commerce sales projected to exceed $32 billion in 2025. Logistics providers are responding with last-mile fulfilment hubs near HCMC, Hanoi, and Da Nang, helping global brands meet rising delivery standards.

Smarter Logistics Through Technology

Across the region, 3PLs are investing in tech to streamline operations:

- AI-driven routing and warehouse automation

- Digital customs documentation and real-time shipment visibility

- Inventory forecasting tools to reduce stockouts and overages

These tools are moving from early pilot to mainstream use, especially in countries like Singapore and Vietnam where infrastructure supports fast digitalisation.

Where Manufacturing Strengths Lie in the Region

Each Southeast Asian country brings unique manufacturing strengths to the table, which directly shape logistics decisions and regional sourcing strategies.

Vietnam

Vietnam continues to lead in textiles, electronics assembly, and furniture manufacturing, attracting investment thanks to its cost competitiveness and improving infrastructure. This drives demand for integrated logistics services capable of handling both bulk and high-tech exports, particularly to the U.S. and EU.

Thailand

Thailand remains a regional powerhouse for automotive production, ceramics, plastics, and food processing. It also excels in niche design products, making it a go-to for brands seeking both industrial capacity and creative craftsmanship. Well-developed highways and deep-water ports support efficient outbound logistics, especially for time-sensitive or value-added exports.

Indonesia

With a growing focus on metalworking, footwear, and raw material processing, Indonesia is seeing logistics investment shift toward enabling higher-volume, cost-sensitive manufacturing zones. However, congestion at key ports like Tanjung Priok continues to pose challenges, prompting diversification into newer hubs like Patimban.

Malaysia

Known for high-quality electronics and precision tech manufacturing, Malaysia offers a more developed logistics backbone and digital infrastructure. These capabilities align well with industries requiring cold chain, just-in-time delivery, or regulatory-compliant handling.

Cambodia and Myanmar

These lower-cost markets are attracting attention for basic garment manufacturing and labour-intensive production, but limited infrastructure, political instability, and weak logistics networks pose clear limitations. While some brands are experimenting with partial capacity in these countries, most rely on more stable ASEAN partners for critical operations.

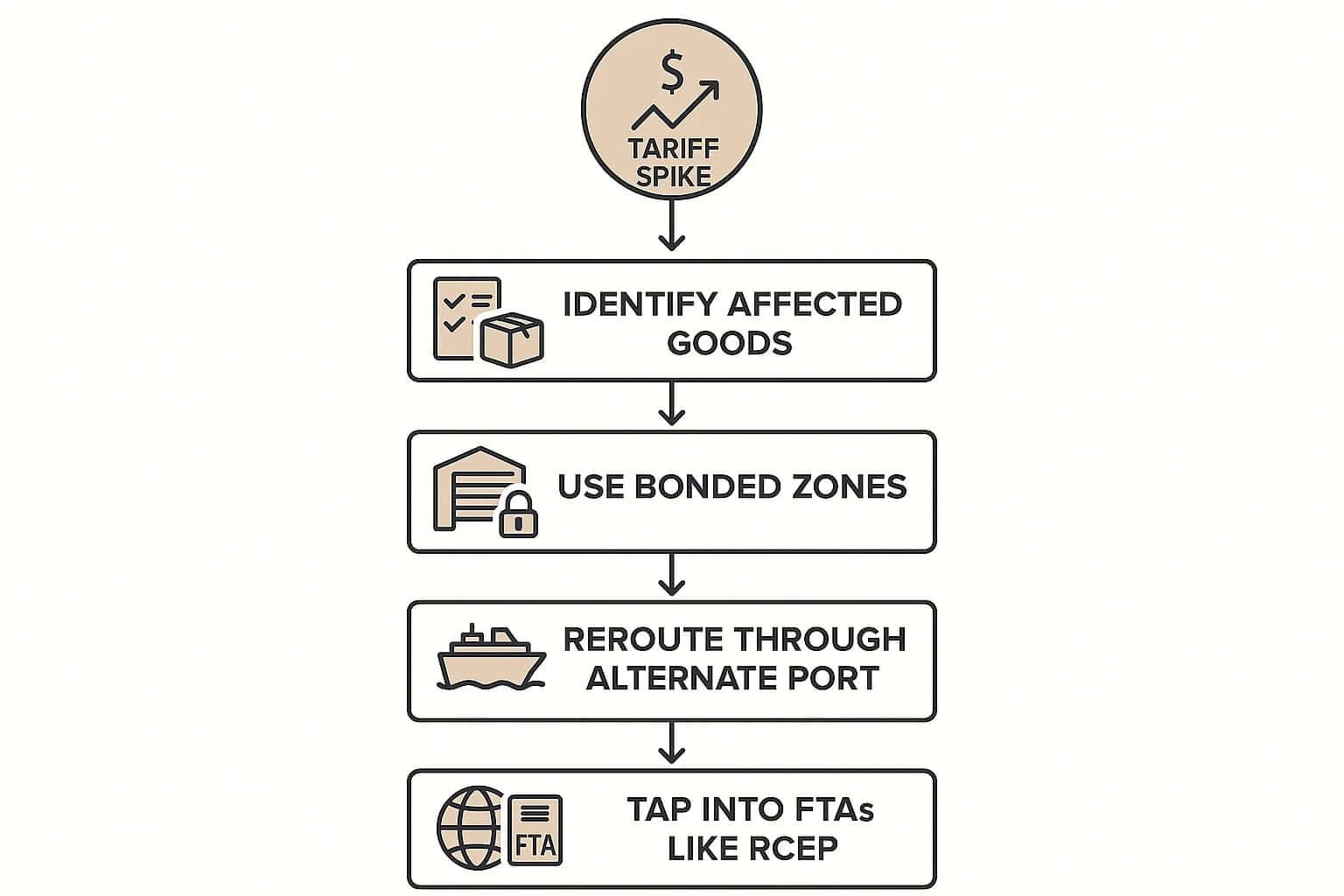

Tariff Volatility & Operational Agility

In 2025, trade policy uncertainty is still shaping logistics decisions. Sudden tariff hikes, shifting trade agreements, and geopolitical flare-ups are forcing businesses to build more agile, multi-route supply chains, especially across Southeast Asia.

Planning for the Unpredictable

Recent U.S. tariff hikes on textiles and electronics from Southeast Asia serve as a reminder: low-cost sourcing regions aren’t immune to political shifts.

To manage risk, companies are:

- Using bonded logistics zones and free trade zones to defer or reduce duty exposure

- Splitting shipments across multiple origin points or port gateways

- Tapping into trade frameworks like RCEP and CPTPP to optimize preferential access

Vietnam, for example, is increasingly a preferred location for routing goods into markets like the EU under EVFTA agreements, and as at the time of writing in July 2025, it has secured one of the better tariff agreements with the US. But similar strategies are emerging in Malaysia and Indonesia as well.

Building Flexibility Into the Network

Operational flexibility is becoming a core sourcing KPI. That means:

- TMS platforms that track tariff changes in real time

- Supply contracts structured for fast origin-switching

- Port and 3PL partners that support dynamic reallocation of cargo flow

We work with clients to assess tariff scenarios and design network models that hold up under pressure, whether it’s a policy change, shipping delay, or regional disruption. When agility is built into the logistics layer, sourcing decisions become more resilient by default.

At SourceOne, we help clients navigate these dynamics with sourcing strategies and logistics support that reflect where the region is headed. Whether you’re shifting capacity, exploring dual sourcing, or realigning distribution hubs, we provide local insight and practical execution across Southeast Asia’s evolving logistics