Global manufacturing is in the middle of a fundamental reset. Rising labor costs in China, continuing trade tensions, and the desire for more secure supply chains are prompting many corporations to diversify their manufacturing strategy. For organizations searching for long-term value, Southeast Asia has become one of the most enticing possibilities.

The area provides a compelling combination of advantages: reasonable labor expenses, a youthful and talented workforce, strategic geographic location, and access to robust trade agreements like RCEP. Countries such as Vietnam, Thailand, and Indonesia are garnering record amounts of international investment, with companies from electronics to automotive relocating operations to their industrial zones.

In this article, we’ll investigate why Southeast Asia is increasingly becoming the go-to location for global manufacturing investment, and what firms should keep in mind when planning their sourcing approach in this dynamic region.

Competitive Labor Costs and Human Capital

Labor remains one of the strongest pull factors for investors choosing Southeast Asia. While wages in China have risen significantly over the past decade, countries like Vietnam, Indonesia, and Cambodia continue to offer a lower-cost environment without compromising too much on skill.

Cost Advantage Over Established Hubs

- Average manufacturing wages in Vietnam are estimated at less than half of China’s, making it one of the most cost-competitive destinations in Asia.

- Cambodia and Indonesia also present attractive options for labor-intensive industries such as garments, footwear, and furniture.

- These savings are drawing manufacturers across sectors, from consumer electronics to apparel.

Expanding Skilled Workforce

Cost alone does not explain the region’s appeal. Southeast Asia also has a young population entering the workforce each year, with governments investing heavily in training programs. Thailand’s emphasis on technical education and Vietnam’s growing pool of engineering graduates are examples of how the region is moving up the value chain.

For businesses assessing long-term sourcing strategies, this combination of affordability and human capital depth is highly appealing. We help clients analyze these labor market dynamics to ensure they select the right country and supplier base that matches both current cost goals and future scaling needs.

Strategic Geographic Positioning

One of Southeast Asia’s greatest assets is where it is based. The area is naturally a center for global commerce since it is located between China and India, two of the world’s foremost marketplaces, and it is also a gateway to Europe and North America.

Proximity to Major Consumer Markets

Manufacturers gain from shipping times that are shorter to Asia’s economies that are developing the quickest. Electronics created in Vietnam can arrive in China in a few days, while clothes made in Cambodia can get to regional retail markets swiftly.

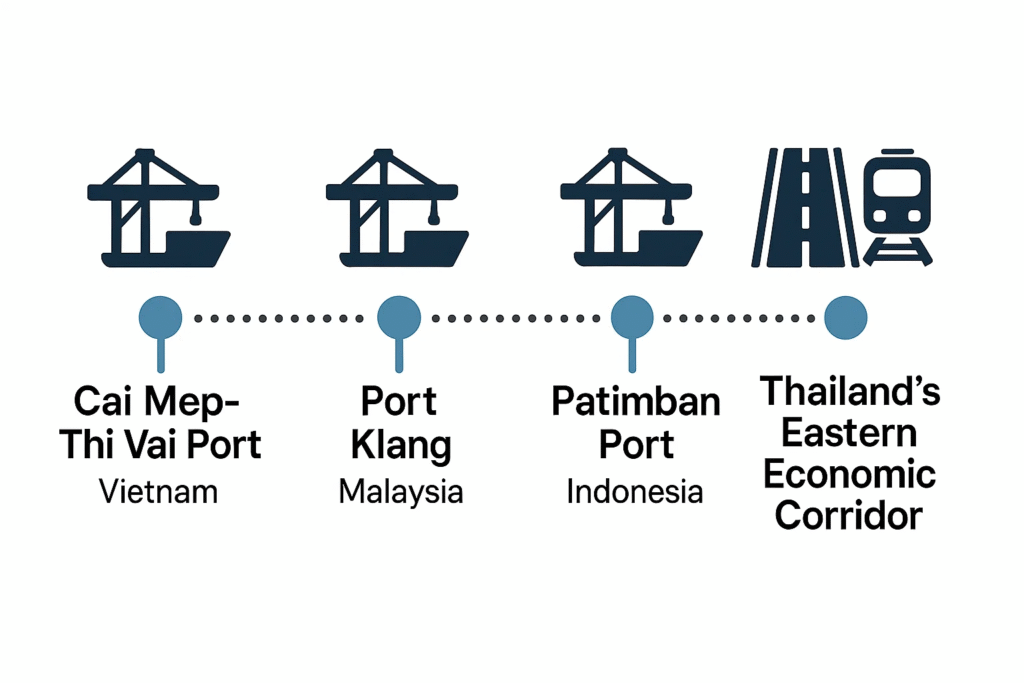

Infrastructure Improvements

The area has been investing significantly on transportation and logistics infrastructure. Vietnam’s Cai Mep-Thi Vai port is becoming more expansive so it can accommodate more containerized exports, while Malaysia’s Port Klang is scaling so it can take more spacious ships. Road and rail projects, such as the North-South Expressway in Vietnam and Thailand’s Eastern Economic Corridor, are enhancing interior connectivity and lowering freight delays.

Trade Integration and Market Access

Global investors benefit from Southeast Asia’s lower rates, and the area also offers good trade connectivity that makes it less complicated for manufacturers to sell into different markets without unnecessary obstacles.

ASEAN as a Trade Bloc

The 10 ASEAN member nations have gradually moved toward unifying trade laws and cutting tariffs. This has produced an interconnected market that enables regional supply chain clustering. A facility in Thailand, for example, may obtain components from Malaysia and send completed items to Vietnam with fewer trade restrictions, enhancing efficiency throughout the bloc.

Global Trade Agreements

Southeast Asia is also firmly connected to global markets via accords such as the Regional Comprehensive Economic Partnership (RCEP), which currently includes almost one-third of global GDP. Vietnam’s trade accord with the EU and Singapore’s agreements with the U.S. and European partners further illustrate the region’s reach.

For corporations analyzing long-term sourcing strategy, this network of trade agreements greatly decreases risk. We regularly see clients benefit from these agreements to boost their earnings and speed up market entrance, making Southeast Asia a sensible option to more limited or high-cost markets.

Industry Diversification and Investment Flows

One of Southeast Asia’s biggest strengths is the diversity of industries it supports. Investors are not limited to a single sector but can tap into a wide range of manufacturing opportunities across the region.

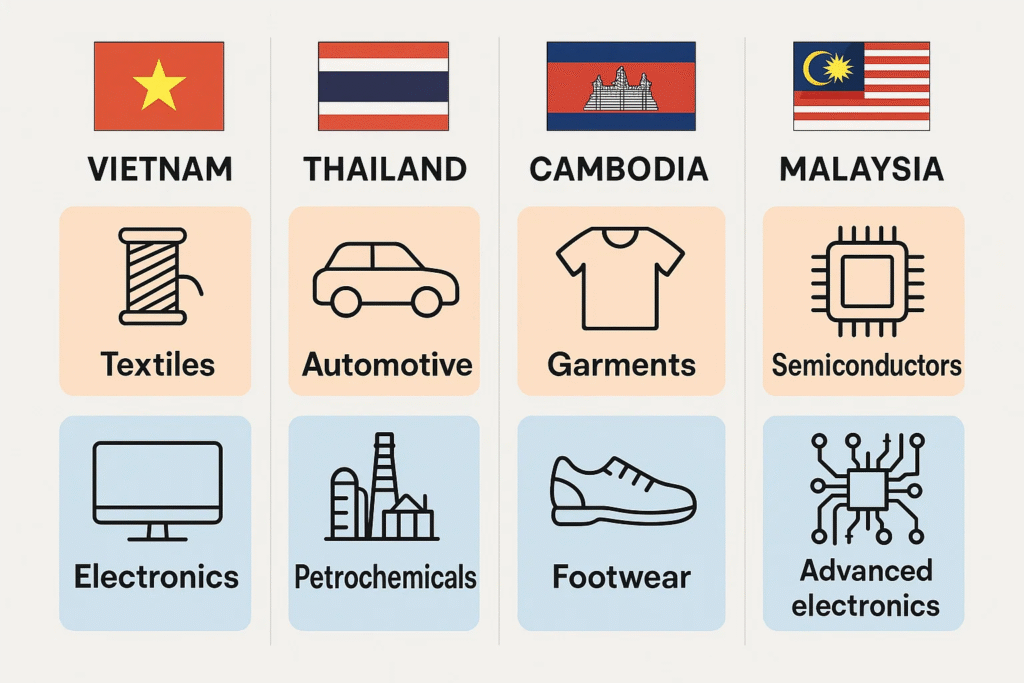

Sectoral Strengths Across the Region

- Vietnam has become a global leader in textiles, apparel, and increasingly electronics. Major technology companies are relocating assembly lines here to spread risk away from China.

- Thailand is positioning itself as a hub for automotive and petrochemicals, with EV-related investments accelerating.

- Cambodia remains a cost-competitive player in garments and footwear.

Malaysia has carved out a niche in higher-value industries such as semiconductors and advanced electronics.

This industry spread reduces dependency on a single sector and offers investors flexibility in building regional supply chains.

Foreign Direct Investment (FDI) Trends

FDI inflows are hitting record levels. Vietnam alone attracted more than $38 billion in committed FDI in 2024, much of it aimed at electronics and high-tech manufacturing. Indonesia has seen strong investment in energy-intensive industries such as batteries and nickel processing. These flows confirm the region’s growing importance on the global stage.

Risk Management and Sustainability Considerations

While Southeast Asia offers clear advantages, it is not without challenges. Investors must recognize that the region’s diversity also means differences in regulations, governance, and sustainability practices.

Political and Regulatory Variability

- Some countries, such as Singapore and Malaysia, provide highly predictable legal and business environments.

- Others, including Cambodia and Myanmar, carry more political risk, requiring closer due diligence.

- Shifts in labor laws or tax incentives can impact cost structures quickly, making supplier vetting and contract flexibility essential.

Focus on Sustainable Supply Chains

Sustainability is gaining prominence as investors and consumers demand more accountability. Vietnam and Thailand are expanding renewable energy infrastructure to support greener manufacturing, while multinational buyers increasingly require ESG reporting from their Southeast Asian suppliers. Companies that fail to meet these expectations risk losing contracts.

We work with businesses to evaluate cost and capacity but also regulatory stability and sustainability practices. This ensures sourcing strategies remain resilient while meeting global compliance and ESG requirements.

Southeast Asia’s Role in the Future of Manufacturing

Southeast Asia has moved beyond being a low-cost alternative and is now a central player in global manufacturing strategies. Competitive labor, skilled talent, strategic location, and robust trade integration make it a top destination for investment. At the same time, the region’s industry diversity and rapid infrastructure growth continue to strengthen its appeal.

However, businesses must account for regulatory differences and rising sustainability expectations. Those that invest in careful supplier selection, long-term partnerships, and compliance monitoring will find the region not only cost-effective but also resilient and future-ready.

At Source One, we guide clients through these decisions with on-the-ground expertise across Southeast Asia. From identifying the right country to managing supplier networks and ensuring ESG compliance, we help companies build supply chains that balance efficiency with long-term growth.