Global buyers are beginning to look at Southeast Asia through a different lens. The region has long been known for competitive manufacturing in electronics, textiles and consumer goods, but it is now gaining attention for something far more advanced: biomanufacturing. With strong agricultural feedstocks, improving infrastructure and rising government investment, countries such as Thailand, Vietnam and Indonesia are positioning themselves as potential centers for fermentation-derived ingredients, bio-based materials and sustainable industrial inputs.

At the same time, procurement teams face practical questions. Biomanufacturing requires stable utilities, consistent feedstock supply, reliable regulatory frameworks and strict quality controls. Buyers want to know whether Southeast Asia can meet these expectations at scale. They also need clarity on cost structures, supplier maturity and the risks of building a supply chain in markets where bioprocessing capabilities are still developing.

In this article, we explore the region’s potential and give you a realistic view of what global buyers should expect when sourcing bio-ingredients and fermentation-based products from Southeast Asia. You will see where the opportunities lie, where the challenges remain and how a structured sourcing strategy can help you make informed decisions in a fast-moving sector.

What Are the Drivers of Biomanufacturing Potential in Southeast Asia?

Low-Cost Production Base and Abundant Feedstock

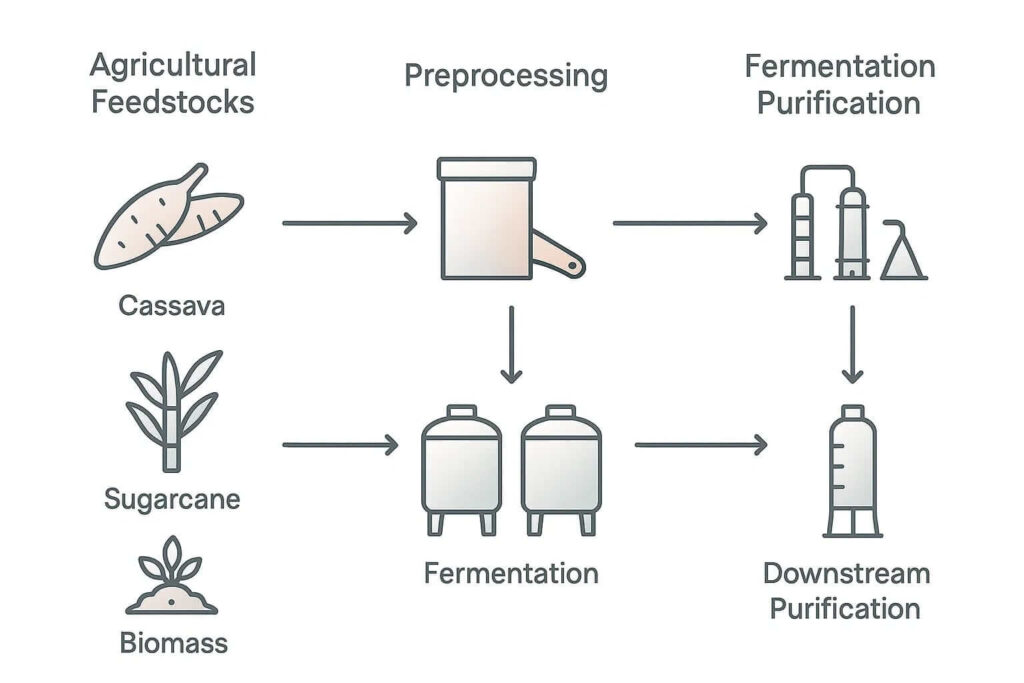

Southeast Asia offers something that most high-tech biomanufacturing regions struggle with: large, affordable feedstock supply. Thailand has strong sugar and cassava production, Vietnam has rapidly scaled its starch and biomass processing industries, and Indonesia offers significant agricultural by-products that can support fermentation. These inputs matter because feedstock cost often determines whether a biomanufactured ingredient is commercially viable.

Labor and utility costs also remain competitive compared with Europe, the United States and parts of East Asia. For fermentation processes that run continuously and consume high levels of energy and water, these differences can add up quickly. Several governments in the region have begun investing in industrial zones where water treatment, waste handling and energy supply are designed specifically for biotech and bio-processing activities. These clusters help reduce overhead costs and give suppliers a stronger foundation for scale.

Investors have already taken notice. Multiple alternative-protein and bio-ingredient companies have announced pilot or commercial-scale facilities in Thailand and Vietnam. Their decision to set up operations here is often driven by cost advantages combined with proximity to major consumer markets.

Policy, Regulatory and Strategic Positioning

Many governments in Southeast Asia have identified the bioeconomy as a strategic opportunity. Thailand’s BCG (Bio-Circular-Green) strategy is one example. Vietnam has addressed biotechnology as part of its long-term economic development plans. Indonesia is exploring ways to build domestic capability through incentives and public-private partnerships. These initiatives create a more welcoming environment for biomanufacturing investment and support companies that want to produce fermentation-based products for global markets.

The region’s geographic position gives it another advantage. It sits close to China, Japan, South Korea and Australia, which represent major demand centers for specialty bio-ingredients. Shipping times into Europe and the United States remain competitive, and diversification away from single-country supply chains is now a priority for many global brands. Southeast Asia offers a middle ground that balances cost, capacity and geopolitical resilience.

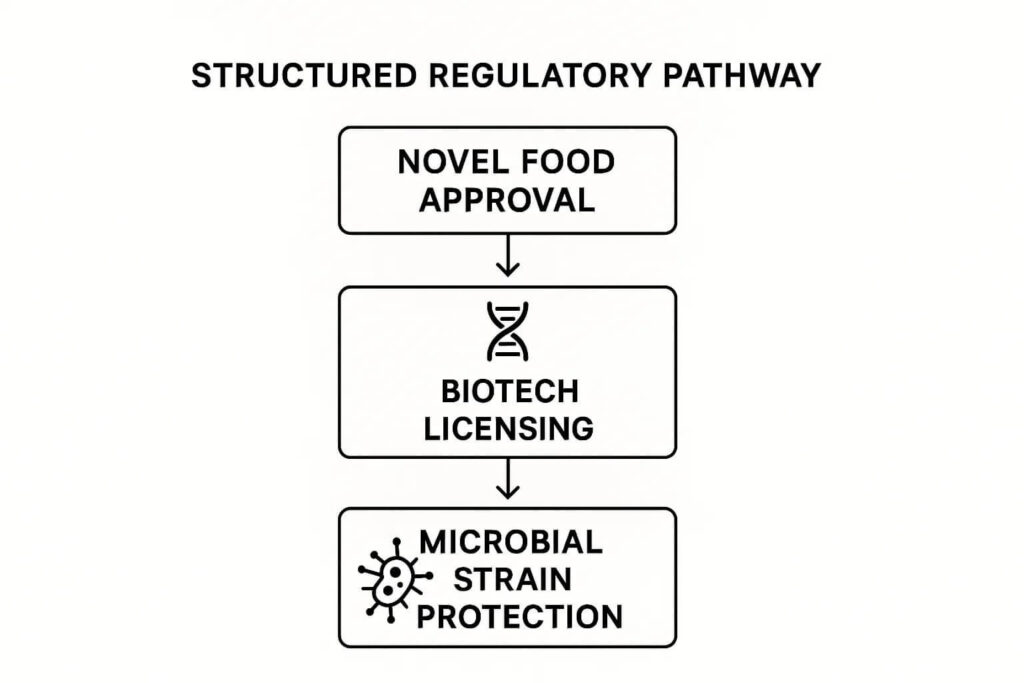

Regulations around novel foods and fermentation-derived ingredients are still evolving in several countries. That is a challenge, but it also signals that governments are actively shaping policies to accommodate new technologies. Early regulatory engagement helps buyers and manufacturers align expectations before scaling production.

Many buyers choose to work with partners who provide all-inclusive sourcing services, particularly when dealing with new categories or rapidly growing industries.

Market Demand Trends and Global Supply Chain Re-Shaping

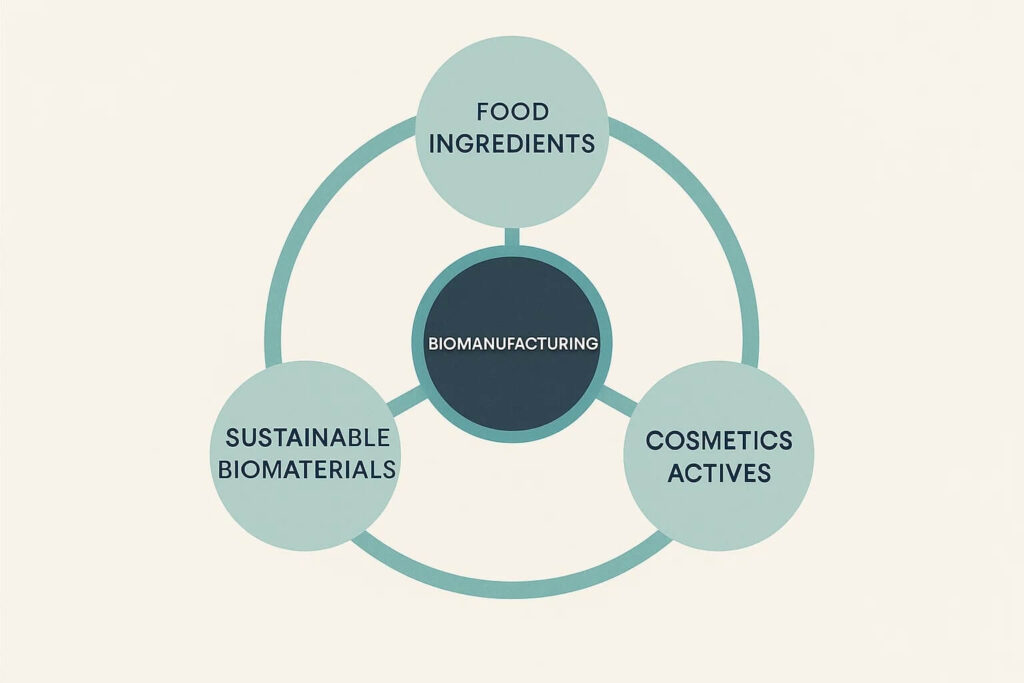

Demand for biomanufactured products is rising quickly. Food companies need fermentation-derived proteins and flavor molecules. Cosmetics brands are sourcing bio-based actives. Materials companies are exploring fermented polymers and specialty biomaterials. As this demand grows, buyers need more global capacity, not just traditional hubs in the United States or Europe.

Southeast Asia’s manufacturing ecosystem is shifting to meet this demand. Several markets have started building mid-scale and commercial fermentation capacity that plugs directly into global supply chains. Companies that once relied heavily on China are now looking at regional diversification. This does not replace China’s role, but it gives buyers additional options and reduces single-market risk.

Biomanufacturing Comparative Analysis: Thailand, Vietnam, Indonesia

Thailand

Thailand is emerging as one of the strongest contenders for biomanufacturing in Southeast Asia. The country has a reliable supply of sugarcane, cassava and other high-yield crops that support cost-efficient fermentation. Its industrial base is also mature, with established manufacturing zones and government incentives that appeal to foreign investors. Several global alternative-protein and bio-ingredient companies have selected Thailand for pilot facilities because of its stable infrastructure and predictable operating costs.

Where Thailand still needs improvement is in regulatory clarity for novel and fermentation-derived products. Approval pathways can take time, and buyers sometimes face uncertainty when evaluating long-term compliance. Even so, the combination of feedstock availability and government support places Thailand at the front of the regional pack.

Vietnam

Vietnam offers some of the most competitive cost structures in the region. Labor remains affordable, utilities are improving and the government supports foreign investment in biotechnology. The country has gained a reputation for building production capacity quickly, which is attractive for fermentation companies that want to scale from pilot to commercial volumes.

What Vietnam lacks is deep research infrastructure. The country is building capability, but its technical workforce and large-scale fermentation ecosystem are still developing. Buyers may also encounter supply chain gaps, especially when it comes to advanced equipment or specialized support services. Despite these gaps, Vietnam’s momentum is strong, and many investors see it as a promising long-term manufacturing base.

Indonesia

Indonesia has a substantial biomass resource base, which includes palm by-products, coconut, cassava and other agricultural inputs that can support fermentation. The country also has a large internal market, growing industrial zones and an expanding interest in bio-based industries.

However, Indonesia presents more logistical and regulatory complexity than Thailand or Vietnam. Infrastructure varies significantly by region, and local compliance processes can take time to navigate. Buyers need to work with suppliers who have stable documentation, clear traceability and proven manufacturing practices. For companies willing to invest in supplier qualification, Indonesia offers significant long-term potential because of its scale and resource availability.

Sustainability remains central to this category, which is why many teams incorporate stronger criteria drawn from ethical sourcing and sustainability in modern procurement.

Risks and Challenges for Buyers Sourcing Biomanufactured Products in the Region

Infrastructure, Scalability and Quality Assurance

Biomanufacturing depends on stable utilities and precise process control. Not every facility in Southeast Asia is equipped for continuous fermentation at commercial scale, and this creates variability across suppliers. Some plants run smaller pilot systems that cannot meet global volume requirements, while others may face interruptions in water treatment, waste handling or electricity. These factors can influence consistency, yield and overall production reliability.

Quality systems also vary widely. Buyers need confidence that suppliers can maintain global standards for QC, microbial safety and batch traceability. GMP-level controls are not yet standard across the region. Some suppliers are moving quickly to upgrade, but others still rely on manual record-keeping or process adjustments that increase production risk. A gap here can affect not only product quality but also regulatory acceptance in major markets.

Regulatory and Compliance Uncertainties

Fermentation-derived products often fall into regulatory categories that are still evolving in Southeast Asia. Novel food approvals, biotech licensing and strain-protection frameworks differ from country to country. Thailand offers strong investment incentives but slower regulatory clarity. Vietnam is working to modernize its policies, though approvals can take time. Indonesia has its own set of regulations that buyers must navigate carefully.

These uncertainties can slow down product launch timelines or introduce unexpected compliance requirements. They can also create challenges around IP protection, especially when microbial strains or proprietary fermentation processes are involved. Buyers who rely on strict regulatory alignment need to factor these variations into their planning.

Sourcing- and Procurement-Specific Challenges

Biomanufacturing is not a typical procurement category. Buyers must evaluate suppliers on more than cost and capacity. Feedstock sourcing needs to be consistent. Inputs must be traceable. Fermentation yields should remain stable over time. Many suppliers are still adapting their internal processes to meet these expectations.

Local supplier ecosystems can also be fragmented. Some companies specialise in fermentation but outsource downstream processing. Others have strong fermentation capability but limited storage or drying capacity. Understanding these details helps buyers avoid quality shortfalls or delays.

Finally, supplier qualification is more complex than in traditional manufacturing. On-site audits, process validation and documentation checks are often required. This takes time and requires local knowledge. Working with teams who understand the region’s biomanufacturing landscape becomes essential when scaling orders or introducing new bio-ingredients to global supply chains.

Some organizations also rely on procurement outsourcing models when they want deeper regional insight without building new internal capability.

Positioning Southeast Asia as a Strategic Biomanufacturing Partner

Southeast Asia is building real momentum in biomanufacturing. Strong feedstock availability, competitive operating costs and growing government support make the region attractive for companies sourcing fermentation-derived ingredients and bio-based materials. At the same time, buyers must approach the opportunity with a structured evaluation process. Facility readiness, regulatory alignment, quality systems and supplier experience all play a role in determining whether a project can scale smoothly.

A clear procurement framework helps teams avoid missteps. It also creates the visibility needed to compare suppliers across Thailand, Vietnam and Indonesia.

For buyers moving into biomanufacturing, at Source One we have found that the most successful strategies combine regional knowledge, technical understanding and thorough supplier qualification. With this approach, Southeast Asia can become a dependable extension of your global supply chain.