The automotive industry is undergoing a profound transformation, and in 2025, sourcing is at the heart of it. Between shifting trade dynamics, the electrification boom, and growing ESG scrutiny, Original Equipment Manufacturer (OEMs) and Tier-1 suppliers can no longer rely on traditional procurement models to stay competitive.

At Source One, we understand that global sourcing strategies are being rebuilt to prioritize resilience, flexibility, and future readiness. That means rethinking where materials come from, how supply risk is managed, and what technologies enable smarter decision-making. In this article, we’ll explore how the world’s top automotive players are adapting their sourcing strategies, and what that means for businesses navigating today’s volatile global landscape.

New Market Realities Driving Sourcing Change

Sourcing in the automotive sector has always been complex, but 2025 has raised the stakes. Between unpredictable trade policies, evolving technology, and tightening margins, supply chain leaders are under pressure to rethink the fundamentals.

Stagnating Sales and Shifting Consumer Behavior

Global auto sales are plateauing. According to S&P Global Mobility, light vehicle sales are expected to reach 89.6 million this year, which represents just a 1.7% increase. In mature markets like the US and EU, consumers are delaying purchases due to high interest rates and waning EV incentives.

This slowdown is forcing OEMs and Tier‑1s to recalibrate their sourcing strategy, not just to reduce cost, but to remain agile. Supply chain structures built for mass production must now support lower, more flexible production runs across diverse drivetrains and vehicle classes.

Tariffs, Trade Wars, and Uncertainty

The risk of tariffs is back in the spotlight. The US is considering renewed duties on China, and trade friction with Canada and Mexico could affect key automotive components under USMCA. At the same time, China is tightening its grip on rare earth exports, disrupting the battery materials market.

For sourcing teams, this means actively diversifying origin points and adjusting sourcing playbooks to stay ahead of volatility. That’s where experienced partners like our team at Source One can add value, offering support with dual-origin sourcing models, FTA navigation, and risk-weighted supplier selection.

Tariff Management & Friend-Shoring in Sourcing

The automotive supply chain in 2025 is being reshaped by geopolitics. Tariffs, trade disputes, and raw material nationalism are forcing procurement leaders to get creative fast.

Nearshoring Critical Inputs

Sourcing battery components, wire harnesses, and structural parts closer to final assembly plants is now a key priority. Many OEMs are turning to Mexico, Vietnam, Thailand, and India as reliable alternatives to China.

Why?

- Nearshore options reduce shipping times and carbon footprint.

- They mitigate exposure to tariffs and bottlenecks at major ports.

- They align better with regional compliance and labor expectations.

Trade Strategy Is Becoming Part of Sourcing

It’s not just about finding the lowest price. The value lies in structuring supplier networks to navigate complex trade agreements and regulatory environments.

Companies are:

- Splitting production across multiple countries to leverage free trade agreements

- Using bonded warehouses or dual-origin strategies to manage tariff risk

- Reviewing supplier RoO (Rules of Origin) documentation to stay USMCA/EU-compliant

At Source One, we help automotive clients build and optimise sourcing strategies that balance cost, compliance, and resilience. From vetting suppliers to managing cross-border logistics, we make sure your global sourcing plan holds up under pressure.

Electrification & Raw-Material Security

As EV adoption grows, automakers are racing to lock in raw materials and reconfigure their sourcing strategies. Batteries now account for up to 40% of a vehicle’s total cost, and the supply chain that feeds them is anything but stable.

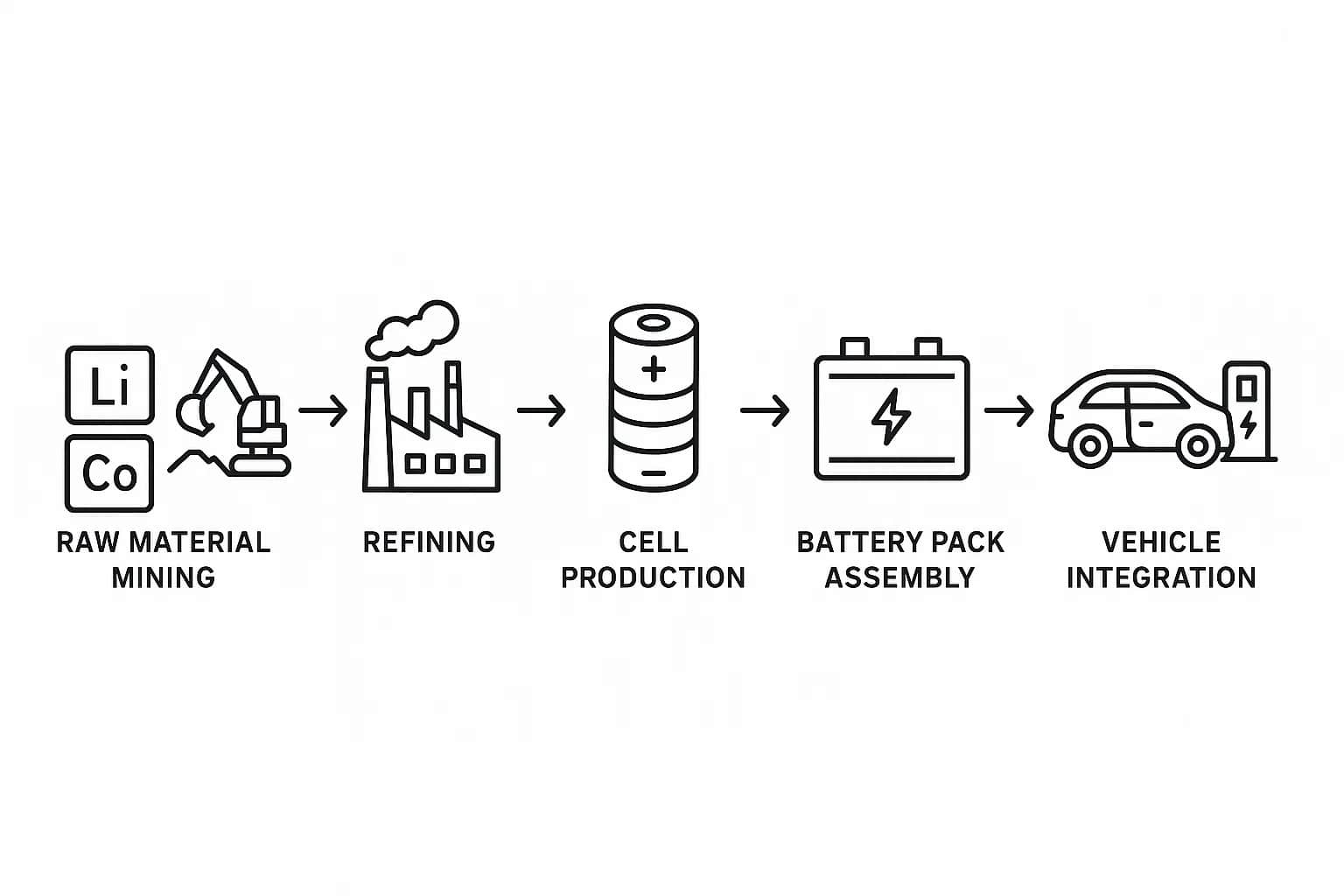

Building EV‑Ready Supply Chains

The demand for lithium, cobalt, and nickel continues to outpace supply. Many OEMs are responding with direct investments in mining operations, refining facilities, or long-term contracts with critical material suppliers.

Others are turning to joint ventures or strategic alliances to gain greater control and visibility into Tier 2 and Tier 3 sourcing layers.

Examples:

- Volkswagen and Stellantis investing in upstream supply through joint ventures in Canada

- Ford partnering with battery recyclers and regional suppliers to meet IRA content rules

- Tier‑1 suppliers in Southeast Asia building regional battery packs to meet local sourcing thresholds

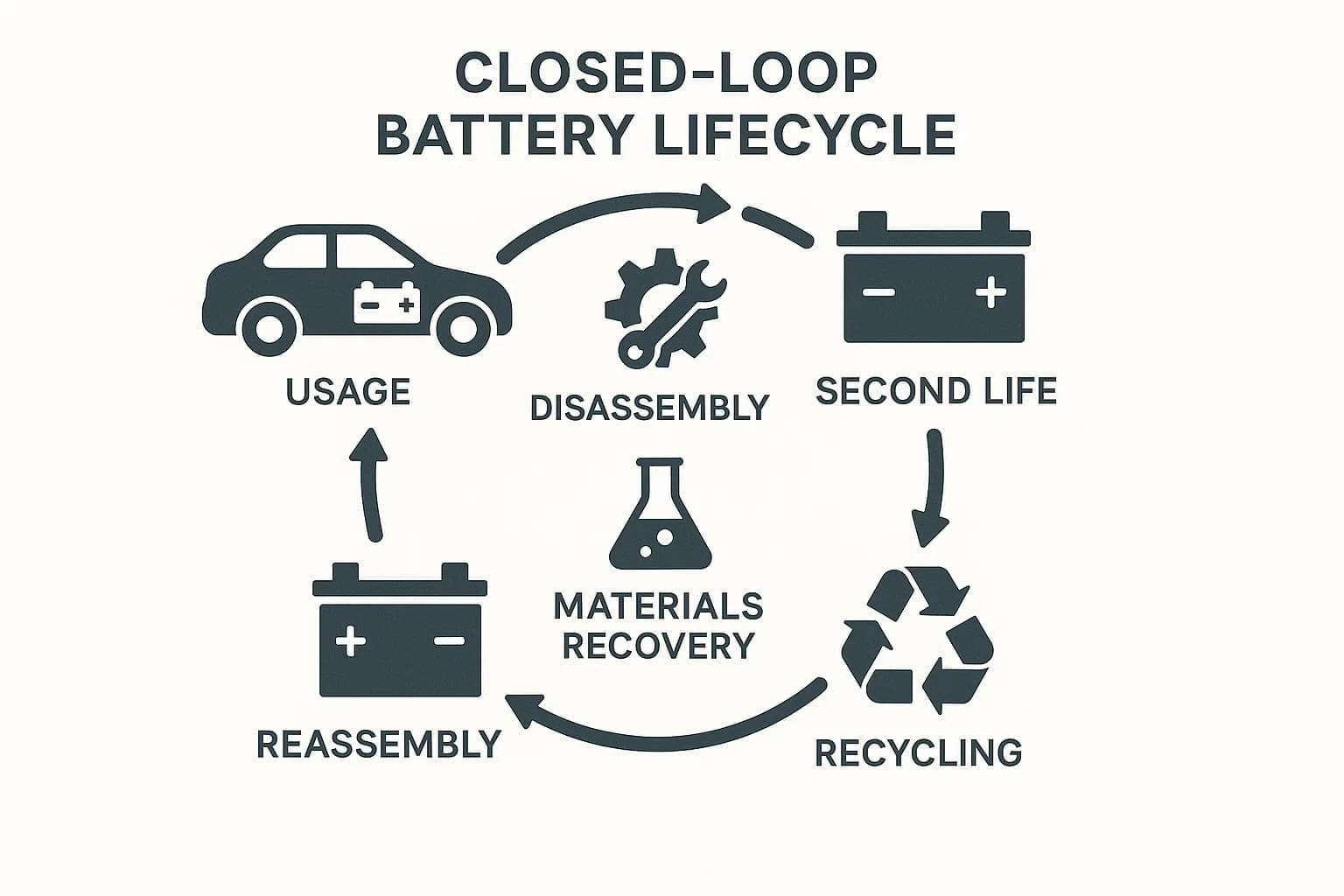

Recycling and Circular Materials Are Part of the Strategy

One emerging solution to resource scarcity: circularity. Leading automakers are now designing battery systems with reuse and recycling in mind.

To prepare, procurement teams are:

- Partnering with recyclers to reclaim lithium, cobalt, and graphite

- Developing second-life applications for EV batteries

- Sourcing modular battery pack components to streamline disassembly and recovery

Sustainability, ESG & Compliance in Sourcing

Sustainability is now embedded in procurement KPIs. In 2025, automakers are expected to go beyond cost and quality to evaluate how suppliers perform on emissions, labor rights, and transparency.

ESG Metrics Are Now Part of the RFP

Supplier evaluations increasingly include:

- Carbon intensity per unit produced

- Verified ethical labor practices across tiers

- Material traceability and environmental impact disclosures

Investors, regulators, and consumers are all demanding clarity, and automakers are passing that pressure down the chain.

Compliance Isn’t Optional

From the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) to the U.S. Uyghur Forced Labor Prevention Act (UFLPA), regulatory expectations are expanding. Non-compliance can mean shipment delays, penalties, or even forced contract termination.

For procurement teams, this means:

- Embedding ESG requirements in contracts

- Conducting third-party social and environmental audits

- Investing in supplier development when gaps are identified

Rethinking Automotive Sourcing for a Resilient Future

The automotive industry’s sourcing model is being reengineered. Between shifting tariffs, EV raw material constraints, regulatory pressure, and rising ESG expectations, procurement leaders must think strategically, act fast, and build for long-term resilience.

Whether you’re navigating nearshoring decisions, vetting battery suppliers, or digitising your procurement function, the right partnerships make all the difference. At Source One, we work alongside manufacturers and suppliers to build agile, compliant, and future-ready sourcing strategies. With global reach and on-the-ground experience, we help you stay competitive in an increasingly complex market.